Travelling allows you to develop a deeper connection with the world. All of us have a great yearning to enrich our lives by leaving our footprints across the globe. Research shows that people who take holidays are more happy and content with their life. They find a broader perspective and outlook of the world. Also, it improves our physical and psychological well-being. Many of us seek convenience to plan our trips, and the travel industry is on guard to meet the changing requirements. In this blog, we will cover:

- UK holiday market insights

- How can a holiday loan help you plan a vacation?

- How to apply for a personal loan for a holiday online?

UK Holiday Market Insights

Excitement climbs up to the peak the moment we start to think about holidays. Enjoying under the hot sun while sipping on Pina Colada is all that we want when we tire ourselves out in the offices rigorously. According to the Travel Trends Report published by the Office for National Statistics (ONS), 71.7 million Brits went overseas in 2018, and they spent £45.4 billion on their visits. Spain was the most visited country by UK residents – 15.6 million visits in 2018.

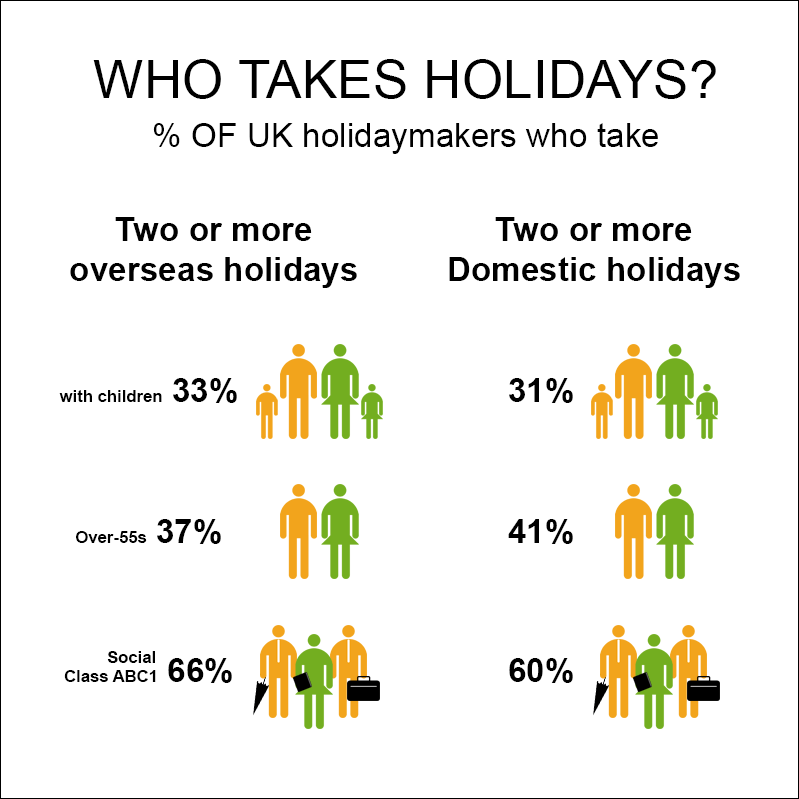

Another report published by Deloitte revealed that 54% of UK adults took at least one overseas holiday and 22% took more than two overseas holidays in 2018. 43% of holiday-makers said they are most likely to make a trip outside the European Union. However, given the current geopolitical backdrop of Brexit, most of the people are sceptical about planning a vacation. The desire to travel is on a constant rise in the United Kingdom.

How Can a Holiday Loan Help you Plan a Vacation

Holiday Loans are nothing but personal loans that allow a borrower to take out an amount up to £35,000. You have the privilege to repay the loan within one to seven years. If you do not want to go through a debt hangover after an exotic trip, then this loan can help you. Moreover, you do not have to offer any collateral as security to apply for the loan. That means your house or car or any other valuables cannot be possessed by the lender if you fail to meet the repayments. You may receive the funds in your bank account within a few hours. The best thing is – you can use the funds in cash mode when you’re travelling. A recent survey conducted by Riviera Travel published that 19% of Brits do not realise the unexpected costs of using credit cards while abroad. Credit cards do offer you the luxury of travelling without carrying any cash. However, the additional costs of using it may lead you to overspend. If you have cash for your expenses, it becomes easier to track your spendings. Also, you do not have to make an immediate repayment as you can spread the cost of it over several months.

How to Apply for a Personal Loan for a Holiday Online?

If you are searching for Holiday Loans in London or from any other major city of the United Kingdom on the internet, you will find a plethora of options. Oyster Loan is a Financial Conduct Authority (FCA) authorised loan broker that operates in the UK. We have a panel of regulated lenders who offer unsecured personal loans. Once you apply online, our lenders will run necessary checks on your credit profile and will assess your creditworthiness to make their decision. You will get to know the result on your screen within a few seconds.

To apply now, Click Here.